THINKING ABOUT SETTING UP A SMSF IN MELBOURNE?

We've put together an introductory guide on Australian Self-Managed Superannuation Funds (SMSF's) and all the common questions we get asked every day.

TABLE OF CONTENTS

Should you start a self-managed super fund?

What is a self managed super fund (SMSF)?

How does an SMSF Work?

What are the benefits of an SMSF?

What can I invest in with an SMSF?

When is the right time to start an SMSF?

How do I Setup a SMSF?

What are the legal requirements of an SMSF?

What is an SMSF Audit?

What is the Sole Purpose Test for SMSF?

When should I consider a SMSF?

How much do I need in my super to start an SMSF?

How many SMSFs are there in Australia?

What types of contributions can a SMSF accept and who can make them?

When can members access their super from their SMSF?

How are SMSFs Taxed?

Can I buy property with my SMSF?

SMSF segment overview

Size of SMSF sector

- SMSFs make up 99.6% of the number of funds and 30% of the $2.3 trillion total superannuation assets as at 30 June 2017.1

- There were 597,000 SMSFs holding $697 billion in assets, with more than 1.1 million SMSF members as at 30 June 2017.2

- Over the five years to 30 June 2017, growth in the number of SMSFs averaged almost 5% annually.

- 53% of SMSFs have been established for more than 10 years, and 16% have been established for three years or less.

Growth of SMSF assets

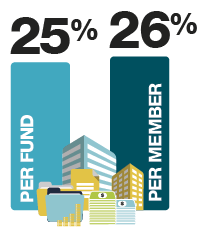

- For the 2015–16 income year, the average assets of SMSFs were just over $1.1 million, a growth of 25% over five years and 3% from 2015.

- Average assets per member grew by 26% over the five-year period to $599,000 in 2016. This was the highest value over the period.

- Average assets per SMSF in their year of establishment increased by 20% from $325,000 for funds established in 2012 to $390,000 for funds established in 2016.

- 49% of SMSFs had assets between $200,001 and $1 million, accounting for 23% of all SMSF assets.

- The majority of SMSF assets were held by funds with assets between $1 million and $5 million, representing 54% of total SMSF assets.

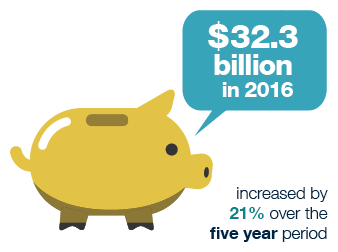

Contributions

- Total contributions to SMSFs increased by 21% over the five years to 2016. This is significantly higher than the growth of total contributions to all superannuation funds (16%) over the same period.

- Member contributions made to SMSFs increased to $25.1 billion or by 31% over the five-year period. While contributions to SMSFs represented 24% of all super fund contributions, SMSFs received 53% of member contributions made across all super funds.

- Employer contributions made to SMSFs fell by 5% over the five years to $7.1 billion in 2016.

SMSF benefit payments

- Benefit payments increased from $22.6 billion in 2012 to $37 billion in 2016. The proportion of SMSF members receiving a benefit payment increased by 16% in 2016.

- In 2016 the average benefit payment was $127,000, and the median payment $62,700.

- In 2016, 94% of all benefit payments were in the form of income stream (including transition to retirement income streams).

- Transition to retirement income streams have remained steady representing 11% of total benefit payments in 2016.

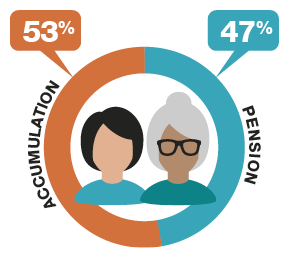

SMSF payment phase

- The majority of SMSFs continued to be solely in the accumulation phase (53%) with the remaining 47% making pension payments to some of or all members.

- Over the five years to 2016, there was a shift of funds moving into the pension phase (4%).

- Of SMSFs that started to make pension payments in 2016, 54% were more than five years old, while 24% were less than two years old.

- Of funds established over the last 10 years to 2016, 70% have not started making pension payments.

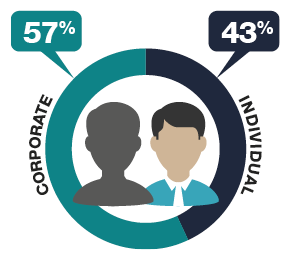

SMSF trustee structure

- At 30 June 2017, 57% of all SMSFs had a corporate trustee rather than individual trustees.

- Of newly registered SMSFs in 2015 to 2017, on average 81% were established with a corporate trustee.

SMSF member demographics

- At 30 June 2017 there were 1.1 million SMSF members, of whom 53% were male and 47% female.

- The trend continued for members of new SMSFs to be from younger age groups. The median age of SMSF members of newly established funds in 2016 was 47 years, compared to 59 years for all SMSF members as at 30 June 2017.

- In 2016, SMSF members tended to be older than members of APRA funds and had both higher average balances and higher average taxable incomes.

- The proportion of members receiving pension payments from an SMSF continued to trend upwards. In 2016, 43% of members were fully or partially in pension phase, compared to 35% in 2012.

SMSF member balances

- At 30 June 2016 the average SMSF member balance was $599,000 and the median balance was $362,000, an increase of 26% and 32% respectively over the five years to 2016.

- The average member balances for female and male members were $511,000 and $641,000 respectively. The female average member balance increased by 30% over the five-year period, while the male average member balance increased by 22% over the same period.

- Over the five years to 2016, the proportion of members with balances of $200,000 or less decreased from 42% to 32% of all members.

- In 2016, the majority of members had balances of between $200,001 and $1 million.

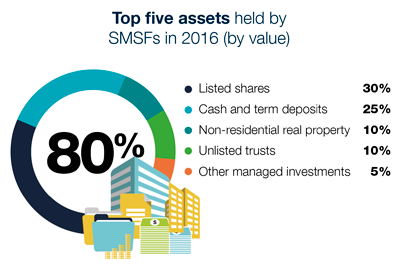

SMSF asset allocation

- SMSFs directly invested 80% of their assets, mainly in cash and term deposits and Australian-listed shares (a total of 54%).

- In the five years to 2016, cash and term deposits decreased (by 7%) to 25% of total SMSF assets.

- As fund asset size increased, the proportion of assets held in cash and term deposits decreased significantly while the proportion of assets held in trusts and other managed investments increased.

- SMSFs in the pension phase had similar assets to SMSFs in the accumulation phase. The only noticeable differences are that SMSFs in pension phase tend to slightly favour listed shares, while those in accumulation phase favoured property assets more.

Limited recourse borrowing arrangement (LRBA) assets

- In 2016, 7% of SMSFs reported $25.4 billion assets held under LRBAs, which is slightly higher than in 2015 (6%). The majority of these funds held LRBA investments in residential real property and non-residential real property. In terms of value, real property assets held under LRBAs collectively made up 93% or $23.7 billion of all SMSF LRBA asset holdings in 2016.

SMSF borrowing

- At 30 June 2016, SMSFs held total borrowings of $19.5 billon representing 3% of total SMSF assets. The average amount borrowed increased from $356,000 in 2012 to $372,000 in 2016.

Investment performance

- In 2015–16, estimated average return on assets for SMSFs was positive (2.9%), a decrease from the estimated returns in 2014–15 (6.0%). This was the same as the investment performance for APRA funds of more than four members (2.9%) and remains consistent with the trend for APRA funds over the five years to 2016.

SMSF expenses

- The estimated average total expense ratio of SMSFs in 2016 was 1.21% and the average total expenses value was $13,700.

- The average ‘investment expense’ and ‘administration and operating expense’ ratios were consistent at 0.65% and 0.56% respectively.

- SMSFs in pension phase incurred higher average total expenses than funds solely in accumulation phase.

- In general terms, the average expense ratios for SMSFs declines in proportion to the increase in fund size.

Service providers

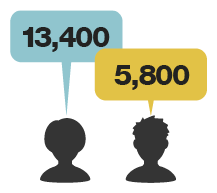

- In 2016, SMSFs used the services of around 5,800 SMSF auditors and 13,400 tax agents or accountants to meet their regulatory obligations.

- In 2016, most SMSF auditors performed between five and 50 SMSF audits (53%), and between 51 and 250 SMSF audits (27%).

- There were 5% of SMSF auditors conducting more than 250 audits, representing 45% of total SMSF audits in 2016.

Feature snapshot: SMSFs first lodged in 2012

For the first time, we have produced a feature piece in addition to the usual sections of this report.

This year we decided to look at SMSFs that lodged their first SMSF annual return in 2012 and traced where they were five years later, in 2016.

We identified 36,160 SMSFs that first lodged in the 2012 financial year. Some of the key highlights of this population include:

- 51% reported total assets of $1 to $200,000 in 2012. Comparatively, this asset range made up only 20% of funds still active in 2016.

- By 2016, 93% of these SMSFs were still in existence. Funds which reported between $1 and $200,000 in 2012 made up 68% of wind ups over the five years.

- 12% of funds were in pension phase when they first reported in 2012. This increased to 34% of funds still active in 2016.

See also:

- For the full analysis, see SMSFs first lodged in 2012 FY: where are they five years on? (infographic) (PDF, 107 KB)This link will download a file

1 APRA 2017, June 2017 Quarterly Superannuation Performance, 22 August 2017, page 8

2 ATO 2017, Self-managed super fund statistical report, June 2017

Should you start a self-managed super fund?

Looking after your own nest egg has become easier and cheaper, but it's still a big decision

If you’re asking that question of your own volition, the answer is probably ‘yes.’

We say that because interest in taking control of your super is half the battle.

Industry and retail super funds promote the idea of a ‘minimum balance,’ but you really don’t need as much as their marketing departments would like you to think. Technology is rapidly eating away at administration costs – you can now run a SMSF for less than $1000 a year through an online provider – so if you’ve got $100,000 or thereabouts you’re in the game.

Before these new services, the minimum required balance was probably at least twice that. Mind you, if you’re planning substantial contributions in the next few years, the current balance isn’t that important.

SMSFs are about taking control of your investing and improving returns since many external funds have been guilty of delivering average, or below average, performance at above average cost. So if you’ve got the commitment and a balance of $100,000 or thereabouts, that’s a good start.

If you set up a self-managed super fund (SMSF), you're in charge – you make the investment decisions for the fund, and you're held responsible for complying with the super and tax laws. It's a significant financial decision, and you need to have the time and skills to do it. There may be better options for your super savings.

An SMSF must be run for the sole purpose of providing retirement benefits for the members or their dependents. Don't set up an SMSF to try to get early access to your super, or to buy a holiday home or artworks to decorate your house. These things are illegal.

What is a self-managed superannuation fund (SMSF)?

SMSF stands for self managed super fund. SMSFs are super funds set up by individuals or a group of less than five people. Self-managed super funds (SMSFs) are a way of saving for your retirement.

A Self Managed Super Fund is a form of trust.

Its sole purpose must be to provide an income upon retirement for its members, or as a death benefit. A SMSF has its own Tax File Number (TFN) and Australian Business Number (ABN), and is required to have its own bank account. The members of the fund simply direct their superannuation contributions into the SMSF bank account, like you would with a retail super fund.

A self-managed super fund (SMSF) is a superannuation trust structure that provides benefits to its members upon retirement. The main difference between SMSFs and other super funds is that SMSF members are also the trustees of the fund. SMSFs can have between one and four members, and one of the main advantages is the level of control that trustees have when it comes to tailoring the fund to meet their individual needs.

As a member/trustee of the fund, you are responsible for ensuring there is an investment strategy for the fund, and implementing investment decisions. Usually, you would discuss your investment objectives with an Investment Adviser and formulate your strategy together.

The difference between an SMSF and other types of funds is that the members of an SMSF are usually also the trustees. This means the members of the SMSF run it for their benefit and are responsible for complying with the super and tax laws.

SMSFs must meet a number of requirements:

- Have a trust deed that meets the requirements of the Superannuation Industry (Superannuation) Act 1993 (SIS Act).

- Members cannot be employees of other members of the fund unless related.

- Trustees cannot receive any remuneration for their services.

- All members must be trustees or, if the trustee is a company, all fund members must be directors of the trustee company.

- Only members can be trustees or directors of the trustee company.

SMSFs with only one member have slightly different rules.

How does an SMSF work?

An SMSF must have its own Tax File Number (TFN) and Australian Business Number (ABN), as well as its own bank account. It's sole purpose is to provide an income upon the retirement of its members, and the members also have the responsibility of ensuring that there is an investment strategy in place.

Who can be a Member/Trustee of a SMSF?

Essentially, anyone 18 years of age and over, who is not under a legal disability, can be a trustee of a superannuation fund, unless they are a disqualified person. Most people can set up their own SMSF for their superannuation guarantee and personal contributions. Employees who are not eligible for super choice may only be able to use an SMSF for personal contributions.

An individual is a disqualified person if they:

- Have ever been convicted of an offence involving dishonesty;

- Have ever been subject to a civil penalty order under the SIS Act;

- Are insolvent under administration;

- Are an undischarged bankrupt or;

- Have been disqualified by the regulator.

SMSF Trustee Structures

There are two types of Trustee structures available to SMSFs.

Individual Trustees

Often a SMSF will consist of a Husband/Wife and potentially children. Every member of the fund must be a Trustee.

Where there is a single member fund, there must be at least 2 individuals to act as trustees on behalf of the fund. In this scenario, the Member must appoint a second person to act as trustee, or consider a company to act as trustee.

The trustees are legally responsible to make decisions on behalf of the fund and ensure the fund remains compliant at all times. As individual trustees you effectively hold the assets of the fund in your name on behalf of the fund.

eg Jason Smith & Jenny Smith as Trustees for Smith Superannuation Fund

SMSF trustees are legally responsible for all decisions concerning the fund. Part of your responsibility as trustee is to ensure you understand the rules governing your fund and to keep abreast of any legislative changes. Other responsibilities include:

- Acting honestly in all matters concerning the fund.

- Exercising the same degree of care, skill and diligence as an ordinary person.

- Acting in the best interest of fund members.

- Retaining control over the fund.

- Keeping money and assets of the fund separate from other monies or assets.

- Developing and implementing an investment strategy.

- Providing members with access to certain information, such as the financial situation of the fund.

Administrative responsibilities include:

- Keeping accurate and accessible accounts for the fund. Accounts must detail the financial position of the fund and its transactions and must be kept for at least five years.

- Preparing an annual operating statement and annual statement of the fund's financial position, which must also be kept for at least five years.

- Maintaining minutes of all trustee meetings and recording any changes to the trustees along with each member's agreement to act as a trustee. Each of these documents must be kept for 10 years.

- Retaining copies of all annual returns lodged for a period of 10 years.

- Retaining copies of all reports given to members for 10 years.

- Reporting all contributions made to the ATO by specified dates each year.

Company Trustee

A company is often utilised to act as a trustee when there is a single member fund (eg an individual wants to be the sole signatory/decision maker and member of the fund and does not have anybody willing to act as the 2nd trustee). A company is established with the member of the super fund acting as a Director of the company.

A Company Trustee may also be preferred by SMSF trustees for ease of administration.

There are additional costs associated with setting up a company and additional paperwork which should be discussed with an Investment Adviser when deciding on your trustee structure.

What do you do with your existing super?

Balances in existing superannuation accounts can transfer to your SMSF, by requesting a ‘roll-over form’. The funds are then paid to your SMSF bank account and available for you to invest.

Can you contribute extra amounts to your SMSF?

Yes you can. Many SMSF members utilise the SMSF as a savings vehicle due to the tax effectiveness of the structure. However, there are limits that you can contribute to your fund and specific rules and regulations apply so you should discuss with an Investment Adviser.

What are the benefits of an SMSF?

There are many benefits when it comes to running your own SMSF. Firstly, the control you have over what you choose to invest in and how is the most important. An SMSF can also borrow to invest via a Limited Recourse Loan. There is also the ability to have more control over tax.

Setting up an SMSF means as a trustee, you can choose how to invest and manage your super savings. Below we explore the main benefits to managing your own superannuation.

Investment Control

Most superannuation funds will allow you to invest into shares, fixed interest and property via managed funds, but often with restrictions. SMSFs however can offer a large range of additional investment options including direct property, physical gold and other commodities, derivatives, and subject to strict requirements, collectables such as art work. SMSFs can also offer the flexibility of borrowing within your fund for investment. In particular, small business owners may hold their business premises within their SMSFs for a variety of reasons including asset-protection, succession planning and security of tenancy.

Greater investment flexibility

SMSF members also have greater flexibility on when they acquire and sell their investments and this hands-on approach can mean, for example, as market conditions change you can quickly respond by adjusting your investment portfolio.

Capacity to pool your super with up to three other individuals

SMSFs provide you with the ability to pool your resources with up to three other members. This increased pool may allow you to access investment opportunities that may not be available otherwise. This further increases when gearing using this increased investment pool is considered.

Estate planning

SMSFs offer great flexibility with your estate planning needs. If the fund’s trust deed allows it, SMSF members can make binding death benefit nominations that do not lapse, unlike many public offer superannuation funds which tend to require binding death benefit nominations to be updated every 3 years. In addition, SMSF members may have greater flexibility in specifying how death benefits are to be paid.

Effective tax management

Control and flexibility over your SMSF investment decisions affords you the ability and means to consider tax when managing your fund’s investments such as the effect imputation credits will have on the after-tax earnings of the fund.

The current tax rate on earnings within a superannuation fund is 15%, however, where the income is produced by assets wholly supporting an income stream such as a pension, there is no tax payable within the fund on that income.

This difference in tax rates means that by having control over the disposal of assets, you can minimise, or potentially eliminate a capital gains tax liability.

Adding value with property

Adding to your SMSF with property can be an effective way to grow your super. Owning property through your SMSF typically involves the fund acquiring a residential or commercial rental property which is leased to unrelated tenants, as fund members or relatives generally can’t rent a residential property from an SMSF because of the in-house assets test. Find our more about how to use a self-managed superannuation fund (SMSF) to access property.

What can I invest in with an SMSF

You can still invest in the common shares, term-deposits, managed funds, and property. You can choose your own shares, and small business owners can invest in buying their own business property through their SMSFs. Many SMSFs hold collectibles such as artwork, jewelry, antiques, and vintage cars.

What types of investments can a SMSF Make?

All investments must meet the single purposes test.

SMSFs can invest in traditional assets such as shares, property, bonds, and cash as well as more complex financial instruments such as options and certain kinds of warrants.

While superannuation law doesn’t stipulate what an SMSF can and can’t invest in, there are restrictions on the entities a fund can invest in and acquire assets from. For example, SMSFs cannot:

Acquire assets from a related party.

Allow in-house assets (such as a loan, investment or lease of a fund asset to a related party) to exceed 5% of total assets.

Borrow money except in limited circumstances.

It is best to seek professional advice if you are considering investing in more complex or non-traditional investments.

We find this is the main reason, so many Australians are establishing their own Self-Managed Superannuation Fund or SMSF for short. The range of investments you can consider for your portfolio includes almost anything you could invest in as an individual including:

- Direct investments (such as shares, ETFs, cash, term deposits, hybrids, income securities, gold/silver bullion and bonds)

- Cryptocurrencies, Bitcoin, Ethereum, initial Coin Offerrings (Just because you can doesn’t mean you should)

- Direct property (Residential houses, villas, units, as well as Commercial property such as offices, warehouses, factory units, shops and land.)

- Managed funds (retail or wholesale, domestic and/or international)

- Private Unit Trusts

- A business (non-related party to avoid hassle) and business property

- Non-traditional assets such as coins, antiques, art , taxi plate licences, ATMs (some of these have been subject to major losses)

Can I invest in equipment and leased it to my business?

Technically yes but there are so many ways you can get in trouble it may not be worth the hassle.

Can I buy a Classic or Vintage Car within my SMSF?

Again technically and theoretically yes you can, but it would be tough with many pitfalls. You’d also have to be able to prove to the ATO that the investment meeting the sole purpose test and was going to generate income for your retirement and not for personal enjoyment now!

You can own, but you or a related party cannot drive it even for maintenance purposes! If you invest in classic cars, they would have to be hired out to generate income. It would be difficult for you to drive. Remember if you are driving you to need to be covered by the vehicle’s insurance, and that would make it obvious to the ATO you are using the car for your own purposes.

Can I use a property within my SMSF?

SMSFs are expressly forbidden from investing in the family home or holiday home for your personal use. But they are able to invest in investment properties – as long as the property is only used for investment purposes. Likewise, properties within holiday resorts or golf courses can draw the ire of the ATO as again you may be seen to benefitting members personally rather than providing for retirement.

This means fund members can’t go and stay in the property or rent it out to family members. The property should generally be managed by a real estate agent to satisfy the sole purpose test regulations unless you can show genuine evidence that you are managing it professionally yourself.

When is the right time to start an SMSF?

For many people, a combination of factors contribute to them starting an SMSF.

Consider the following 4 considerations to see whether you are ready for an SMSF.

1. Do I have enough money to start an SMSF?

A quick answer is that there is no minimum balance required to start an SMSF. This is in contrast to a common rule of thumb in the SMSF industry that you should have at least $200,000 in Superannuation benefits before you consider a Self Managed Super Fund.

2. Do I have enough time and knowledge?

Switching to an SMSF, especially running it with a low-cost SMSF service provider may save thousands of Super fees for you every year. But do you have the time, knowledge & an active interest to build up your Super within an SMSF and at the same time ensure your SMSF is complying with the Superannuation law?

3. I want to buy a Property with my Super.

Another critical benefit of SMSFs is that with an SMSF, you can invest in a broader range of investment options than with Traditional Superfunds – including direct Property. Investing in Property in an SMSF may help you diversify your assets, and potentially save on tax.

4. Am I old enough to start an SMSF?

Age is not a significant factor in the decision process. Starting an SMSF may be equally appropriate for a 30-year-old executive as a 65-year-old retiree.

According to independent researcher Investment Trends, one in every four Australians planning to start an SMSF in the 2014 financial year is under 35. An even higher proportion intends to launch an SMSF shortly, with Gen Ys accounting for 46% of future SMSF investors.

When Investment Trends asked people under 44 why they chose an SMSF, 50% said it was because they wanted to control their own investments. Apart from this, we would like to draw your attention to the Super fees that a Gen Y investor may save when he or she has 20 or 30 years ahead. According to the Australian Securities and Investments Commission, a 1% difference in fees today could mean a 20% difference in your super payout in 30 years.

How Do I setup a SMSF?

To set up an SMSF you need to:

1. Consider appointing professionals like Klear Picture to help you

You can engage self-managed super fund (SMSF) professionals to help you set up and run your fund. You may want to get them involved right from the start since the decisions you make at start-up can affect their ability to help you later on.

If you use an SMSF professional to help you set up your fund, you're still responsible for making sure it's done correctly:

- An accountant can help set up your fund's financial systems and, once you are operating, they can prepare your fund’s accounts and operating statements.

- A fund administrator can assist with administrative tasks during start-up and, afterwards, help you manage the day-to-day running of your fund and meet your reporting and administrative obligations.

- A legal practitioner can prepare and update your fund’s trust deed.

- A financial adviser can help you prepare an investment strategy and advise you about different types of investment and insurance products.The Australian Securities & Investment Commission (ASIC) has information about choosing a financial adviser and things to consider before getting robo-advice. You'll need an approved SMSF auditor to audit your fund.

- A tax agent can complete and lodge your SMSF annual return, provide tax advice and represent you in your dealings with us. You can check if your tax agent is registered at the Tax Practitioners Board.

2. Choose individual trustees or a corporate trustee

You can choose one of the following structures for your fund:

- up to four individual trustees

- a corporate trustee (essentially, a company acting as trustee for the fund).

3. Appoint your trustee or directors

All members of the fund must be individual trustees or directors of the corporate trustee.

New funds usually appoint trustees or directors under the fund’s trust deed.

You need to ensure that the people who become trustees or directors of the SMSF:

- are eligible to be a trustee or director

- understand what it means to be a trustee or director.

All trustees and directors must:

- consent in writing to their appointment

- sign the Trustee declaration stating that they understand their duties and responsibilities (this must be done within 21 days of becoming a trustee or director).

You must keep these documents on file for the life of the SMSF and for 10 years after the SMSF winds up.

Penalties may be imposed if these things aren't done. All trustees and directors are bound by the trust deed and are equally responsible if its rules aren’t followed.

4. Create the trust and trust deed

A trust is an arrangement where a person or company (the trustee) holds assets (trust property) in trust for the benefit of others (the beneficiaries). A super fund is a special type of trust, set up and maintained for the sole purpose of providing retirement benefits to its members (the beneficiaries).

To create a trust, you need:

- trustees or directors of a corporate trustee

- governing rules (a trust deed)

- assets (an initial nominal consideration to give legal effect to the trust can be used, for example, $10 attached to the trust deed)

- identifiable beneficiaries (members).

Trust deed

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund’s objectives, who can be a member and whether benefits can be paid as a lump sum or income stream. The trust deed and super laws together form the fund’s governing rules.

The trust deed must be:

- prepared by someone competent to do so as it's a legal document

- signed and dated by all trustees

- properly executed according to state or territory laws

- regularly reviewed, and updated as necessary.

Assets

To establish your fund, assets must be set aside for the benefit of members.

If a rollover, transfer or contribution is expected in the near future, a nominal amount (for example, $10) can be held with the trust deed. This amount is regarded as a contribution and must be allocated to a member.

If a member can't contribute to the SMSF (for example, they are over 65 or don't meet the work test), an administrative discretion is automatically applied to allow a nominal contribution for the member. The amount must be allocated to the member, solely for the purpose of registering the SMSF.

5. Check your fund is an Australian Super Fund

To be a complying super fund and receive tax concessions, your SMSF needs to be an Australian super fund at all times during the financial year.

If your fund stops being an Australian super fund because it does not satisfy the residency rules, it may become non-complying, and its assets (less certain contributions) and its income are taxed at the highest marginal tax rate.

6. Register your fund and get an ABN

Once your fund is established and all trustees have been appointed (including signing the Trustee declaration), you have 60 days to register the SMSF with us by applying for an Australian business number (ABN).

Two common errors in applications to register an SMSF and get an ABN are:

- The SMSF trust is not set up correctly before applying for an ABN (including setting aside an asset as the SMSF's property). See Create the trust and trust deed for information about setting up a fund.

- The details of the members, trustees or directors of the corporate trustee are incorrect or incomplete. See Associate details for details of the information you will be asked for.

7. Setup a bank account

You need to open a bank account in your fund’s name to manage the fund’s operations and accept contributions, rollovers of super and income from investments. This account is used to pay the fund’s expenses and liabilities.

If you did not provide your financial institution details when you registered your fund, you must provide this information to us now.

The fund’s bank account must be kept separate from the trustees’ individual bank accounts and any related employers’ bank accounts.

You don't have to open a separate bank account for each member but you must keep a separate record of their entitlement, which is called a 'member account'. Each member account shows:

- contributions made by or on behalf of the member

- fund investment earnings allocated to them

- payments of any super benefits (lump sums or income streams).

8. Get an electronic service address

If your SMSF will receive contributions from employers (other than related-party employers), it needs to be able to receive the contributions and associated SuperStream data electronically.

SuperStream is a data and payment standard that applies to super contributions made by employers to any super fund, including SMSFs.

To receive SuperStream data you need an electronic service address, which is a special internet address. It's different to an email address.

Your administrator may provide you with an electronic service address or you can use a SuperStream message solution provider.

An employer will need the following information about your SMSF:

9. Prepare an exit strategy

Even when you're setting up your SMSF you need to consider what happens when your SMSF ends, or 'winds up'.

Sometimes SMSFs become difficult to manage because of an unexpected event such as:

- a relationship breakdown between the trustees

- an illness or accident that leaves a trustee incapacitated (and unable to perform their role as a trustee)

- a trustee dies.

Having an exit strategy may reduce the impact of 'unexpected' events. As part of your exit strategy, some of the things you should consider are:

- ensure all trustees can access the SMSF's records and electronic transaction accounts

- include specific rules in your fund’s trust deed that are triggered by events that could otherwise lead to the fund becoming unmanageable

- members to make binding death benefit nominations (and renew them every three years)

- encourage members to appoint an enduring power of attorney

- the likely costs involved in winding up an SMSF.

What are the legal requirements of an SMSF?

You must be able to comply with the superannuation and tax laws, including making sure the money is only used for retirement benefits. You will also be obligated to keep records, such as lodging annual statements. You must report contributions, and there are also audit requirements, including having the fund audited by an approved SMSF auditor each year.

What is an SMSF Audit?

A SMSF audit involves an approved auditor conducting a financial and compliance audit of your super fund. A financial audit enables your auditor to examine your fund's financial statements. A compliance audit involves assessing your SMSF's compliance with the superannuation rules.

If you run a self-managed super fund, you must ensure that your SMSF is audited annually by an approved SMSF auditor.

An SMSF audit involves an approved SMSF auditor conducting a financial and compliance audit of your super fund. A financial audit enables your auditor to examine your fund’s financial statements. A compliance audit involves assessing your SMSF’s compliance with the superannuation rules.

What is the sole purpose test?

The sole purpose test ensures a super fund’s purpose only provides benefits to its members upon their retirement or for beneficiaries if a member dies. SMSFs can just invest in assets that meet the sole purpose test, which means they must be for the core purpose of providing benefits for retirement. This means trustees cannot derive any current day benefit from assets purchased.

Your SMSF needs to meet the sole purpose test to be eligible for the tax concessions usually available to super funds. This means your fund needs to be maintained for the sole purpose of providing retirement benefits to your members, or to their dependants if a member dies before retirement.

Contravening the sole purpose test is very serious. In addition to the fund losing its concessional tax treatment, trustees could face civil and criminal penalties.

It’s likely your fund will not meet the sole purpose test if you or anyone else, directly or indirectly, obtain a financial benefit when making investment decisions and arrangements (other than increasing the return to your fund).

When investing in collectibles such as art or wine, you need to make sure that SMSF members don’t have use of, or access to, the assets of the SMSF.

Your fund fails the sole purpose test if it provides a pre-retirement benefit to someone – for example, personal use of a fund asset.

SMSFs are also allowed to provide benefits for ancillary purposes such as financial hardship or compassionate grounds subject to super rules and regulations.

When Should I consider a SMSF?

If you want control, and can handle the responsibility, then an SMSF may be for you. You must have enough in your super in order to transfer to an SMSF, and the ATO suggest having $200,000 or more. There will also be many hours put into the creation and monitoring of your SMSF.

How much do I need in my super to start an SMSF?

A quick answer is that there is no minimum balance required to start an SMSF.

If you have $140K or more in super as an individual (or combined with a partner) a Self Managed Super Fund (SMSF) may be suitable for you, the more the better.

The $200,000 myth

It is often said in financial circles that a minimum of $200,000 is needed to establish a new SMSF. However, this is something of an urban myth. In reality, the Australian Securities and Investments Commission (ASIC) does not stipulate that there is a required minimum balance to begin a self-managed fund, although a large start-up amount is recommended. The $200,000 figure is more of a suggested guide as to the minimum amount needed.

How many SMSFs are there in Australia

There are close to 600,000 SMSFs now in operation, managing $696.7 billion in assets as of 30th June 2017, according to the latest statistics released by the Australian Prudential Regulation Authority (APRA), and the Australian Taxation Office (ATO).

What types of contributions can a SMSF accept and who can make them?

SMSFs can accept concessional contributions and non-concessional contributions.

Mandated employer contributions include:

- Superannuation guarantee contributions.

- Employer contributions above SG or award obligations.

- Superannuation guarantee shortfall components.

- Award-related contributions.

- Certain payments from superannuation holding accounts special account.

- Self employed personal contributions (that a tax deduction has been claimed).

- Salary sacrificed contributions.

- Concessional contributions are those that a tax deduction has been or will be claimed for those contributions.

Concessional contributions can be accepted for members at any time regardless of their age and number of hours worked.

Non-concessional contributions include:

- Superannuation guarantee contributions.

- Employee personal contributions.

- Self-employed personal contributions (where no tax deduction has been claimed).

- Other personal contributions and spouse contributions.

There are limits on the types of non-concessional contributions an SMSF can accept:

- Members under 65 can accept non-concessional contributions where they have quoted their tax file number.

- For members between 65 and 69 you can accept non-concessional contributions if the member is gainfully employed (worked at least 40 hours within a period of 30 consecutive days in the current financial year), or non-concessional contributions if the member has quoted their tax file number

- For members between 70 and 75 you can accept employer or member contributions if the member is gainfully employed, or member contributions if the member has quoted their TFN or the contribution is received on or before 28 days after the end of the month the member turns 75. You cannot accept spouse or voluntary employer contributions

- For members 75 and over you cannot accept any non-concessional contributions

When can members access their Super from SMSF?

Members can access their super benefit tax-free at the age of 60 as a lump sum or pension.

Members who want to access their super as a lump sum or commutable retirement income stream will need to be retired and of preservation age. A commutable income stream provides the flexibility to convert an income stream into a lump sum at a later date.

Your preservation age depends on your date of birth.

|

Your date of birth |

Your preservation age |

|

Before July 1960 |

55 |

|

July 1960 to June 1961 |

56 |

|

July 1961to June 1962 |

57 |

|

July 1962 to June 1963 |

58 |

|

July 1963 to June 1964 |

59 |

|

After June 1964 |

60 |

If you are aged between 55 and 60, you can ease yourself into retirement under the Government’s Transition to Retirement rules. This way you can continue working full or part time while drawing an income from your super.

How are SMSFs Taxed?

There are three levels of taxation on SMSFs.

Contributions tax

If the money paid into your super has yet to be taxed, it will attract a 15% tax on the way into the fund. This is known as concessional or salary sacrifice contributions. There is no contributions tax if your money has already been taxed. This is called non-concessional contributions.

Tax on earnings

While in the accumulation phase, the income you earn on your investments within your SMSF is taxed at a maximum rate of 15%. Capital gains are also subject to income tax.

When the SMSF is in the pension phase, all income and capital gains are tax-free.

Tax on benefits

There is no tax on lump sum super or pension benefits paid to people age 60 and over, provided a condition of release has been satisfied.

If you roll your benefit into a superannuation income stream product, you pay no tax on investment earnings (which includes any realised capital gains). You will also pay no tax on your income payments if you're over 60 or have satisfied a condition of release. If you have reached your preservation age and are under 60, your pension may be taxed at your marginal tax rate. A 15% tax rebate may apply.

Can I buy Property with my SMSF?

Looking to buy property? Why not use your Super?

Investing in Australian property can seem like an unattainable dream. But did you know that you can use a self-managed super fund (SMSF) to buy property through your super - and potentially boost your retirement savings at the same time?

3 reasons to consider Property investment with your Super

1. Diversify your Fund assets

A key benefit of SMSF is that they offer a wider range of investment options than traditional super funds - including direct property. By spreading your savings across asset types, you may help reduce risk while still investing for growth.

2. Build a bigger portfolio sooner

An SMSF can borrow to invest in residential or commercial property, with lenders typically funding up to 70% or 80% of the purchase price. So you can take advantage of low interest rates to build a bigger portfolio now, and potentially earn more income and capital growth in the future. As long as your returns outpace borrowing costs, you'll come out ahead.

3. Potentially save on tax

SMSFs can use negative gearing to claim a deduction for borrowing expenses, just like individuals. And investing through an SMSF can have other tax advantages as well. Rental income paid to your SMSF is generally taxed at just 15%. And if you commence a retirement phase pension in your SMSF, then the rent you receive is tax free. More importantly after commencing a retirement phase pension in your SMSF, any capital gain when you sell the Property is also tax free!

Where can I find more information about SMSF's

Useful websites:

- Centrelink

- Australian Taxation Office

- Australian Prudential Regulation Authority

- Australian Securities and Investments Commission

- Australian Investors Association – self managed super interest group

Our General Advice Warning

The information contained on this website is not intended to be advice. It is for information purposes only. Where any part of this site is construed to be advice it is General Advice only. It has been Prepared without taking into account any individual’s objectives, financial situation or needs. Before any person acts on any information in this document they should consider the appropriateness of the information, having regard to their objectives, financial situation and needs. Before making any decision about whether to acquire a product individuals should seek professional advice from their licensed adviser.